Renters Insurance Quotes: Everything You Need To Know

Renters insurance quotes are essential for protecting your belongings and finances. Understanding the factors that influence these quotes and how to compare them will help you make informed decisions. Let’s delve into the world of renters insurance quotes and explore everything you need to know.

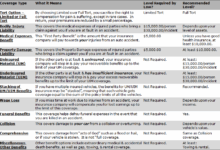

Analyzing Car Insurance Coverage Options

When it comes to car insurance, there are several coverage options available to protect you and your vehicle in different situations. Understanding these options is crucial to ensure you have the right coverage in place.

Types of Car Insurance Coverage

- Liability Coverage: This type of coverage helps pay for damages to another person’s property or medical expenses if you’re at fault in an accident.

- Comprehensive Coverage: Comprehensive coverage helps cover damages to your vehicle that are not caused by a collision, such as theft, vandalism, or weather-related incidents.

- Collision Coverage: Collision coverage pays for repairs to your vehicle if it’s damaged in a collision with another vehicle or object.

Examples of Situations

- Liability Coverage: If you cause an accident and damage another car, liability coverage can help cover the repair costs.

- Comprehensive Coverage: If your car is stolen or damaged by a hailstorm, comprehensive coverage can help cover the cost of repairs or replacement.

- Collision Coverage: If you hit a tree or another vehicle, collision coverage can help pay for the repairs to your car.

Cost Implications of Coverage Limits

- Choosing higher coverage limits may result in higher premiums but can provide more financial protection in case of an accident.

- Opting for lower coverage limits can lead to lower premiums but may leave you financially vulnerable if the damages exceed your coverage limits.

Factors Influencing Renters Insurance Quotes

When it comes to renters insurance quotes, several key factors come into play that can impact the cost of coverage. Understanding these factors is essential for tenants looking to protect their belongings and assets.

Location Impact

The location of the rental property plays a significant role in determining renters insurance quotes. Urban areas with higher crime rates and population density often have higher insurance premiums compared to suburban or rural areas. This is due to the increased risk of theft, vandalism, and other potential damages in urban settings.

Coverage Limits

The coverage limits chosen by the tenant also influence the cost of renters insurance. Higher coverage limits mean greater financial protection but also result in higher premiums. It’s important for renters to assess their needs carefully and choose coverage limits that provide adequate protection without overspending.

Average Quotes Comparison

| Location | Average Renters Insurance Quote |

|---|---|

| Urban | $X |

| Suburban | $Y |

| Rural | $Z |

High-Risk Factors

Certain high-risk factors can significantly increase renters insurance quotes. These may include living in an area prone to natural disasters, having a history of insurance claims, or owning valuable items that require additional coverage. Tenants should be aware of these factors when obtaining insurance quotes.

Property Condition and Age

The age and condition of the rental property can impact insurance rates. Older properties or those in poor condition may pose higher risks for insurers, leading to higher premiums for renters. It’s essential for tenants to consider the state of the property when seeking insurance coverage.

Additional Coverage Options

Adding extra coverage options such as personal property replacement cost or identity theft protection can also affect renters insurance quotes. While these options offer added protection, they come at an additional cost. Renters should weigh the benefits of these options against their budget and coverage needs.

Understanding Coverage Options

Renters insurance offers various coverage options to protect tenants from financial losses due to unexpected events. It is essential to understand the different types of coverage available to ensure you have adequate protection in place.

Types of Coverage Options:

- Personal Property Coverage: This coverage protects your personal belongings, such as furniture, electronics, and clothing, in case of theft, fire, or other covered perils.

- Liability Coverage: Liability coverage helps protect you if someone is injured on your rental property and you are found legally responsible. It can cover medical expenses and legal fees.

- Additional Living Expenses Coverage: This coverage can help pay for temporary living arrangements if your rental becomes uninhabitable due to a covered loss, such as a fire or natural disaster.

Optional Coverages:

- Jewelry Insurance: You can add this coverage to protect valuable jewelry items that may not be fully covered under standard personal property coverage.

- Earthquake Insurance: If you live in an area prone to earthquakes, you may want to consider adding this coverage to protect your belongings from earthquake damage.

- Identity Theft Protection: This coverage helps cover expenses related to identity theft, such as legal fees, lost wages, and credit monitoring services.

Comparison of Coverage Options:

When comparing coverage options from different insurance providers, it is crucial to consider factors such as coverage limits, deductibles, and premium costs. Here is a comparison table highlighting key features of renters insurance coverage from three providers:

| Insurance Provider | Coverage Limits | Deductibles | Premium Costs |

|---|---|---|---|

| Provider A | $50,000 personal property | $500 | $20/month |

| Provider B | $40,000 personal property | $750 | $25/month |

| Provider C | $60,000 personal property | $400 | $18/month |

Tips for Lowering Renters Insurance Quotes

When looking to reduce your renters insurance premiums, there are several strategies that can help you save money and get the coverage you need. One of the key factors in lowering renters insurance quotes is to compare quotes from multiple insurance providers to find the best deal that fits your budget and needs.

Impact of Deductible Amounts

Adjusting the deductible amount can have a significant impact on the cost of your insurance premium. A higher deductible typically results in a lower premium, as you would be responsible for paying more out of pocket in the event of a claim. For example, increasing your deductible from $500 to $1,000 could lead to a decrease in your premium by 15% to 30%.

Bundling Policies for Discounts

Bundling policies, such as combining renters insurance with auto insurance, can lead to discounts on your premiums. By purchasing multiple policies from the same insurance provider, you may be eligible for a discount on each policy. To inquire about bundling options, simply contact your insurance company and ask about the potential savings available.

Comparison Table for Coverage Levels

Here is a comparison table showing the average cost of renters insurance premiums based on different coverage levels:

| Coverage Level | Average Premium |

|---|---|

| Basic Coverage | $10-$20/month |

| Standard Coverage | $20-$40/month |

| Comprehensive Coverage | $40-$70/month |

Understanding Coverage Limits and Exclusions

To ensure you have adequate protection, it’s essential to review and understand the coverage limits and exclusions in your renters insurance policy. Pay close attention to the specific items covered, the maximum amount of coverage provided, and any exclusions that may apply. By understanding these details, you can make informed decisions about your coverage and avoid any surprises in the event of a claim.

Importance of Accurate Information

Providing precise and detailed information when applying for a passport is crucial for a smooth and successful process. Any inaccuracies in the application can lead to delays in processing or even rejection of the application, causing inconvenience and potential travel disruptions.

Personal Identification Data

Accurate personal identification data, such as full legal name, date of birth, and place of birth, are essential for verifying identity and ensuring the passport is issued correctly. Any errors in this information can result in delays or issues with international travel.

Travel History

Accurately documenting travel history, including past trips and visa information, is important for security and verification purposes. Providing incorrect or incomplete travel history can raise red flags and lead to further scrutiny or delays in processing the passport application.

Emergency Contacts

Including accurate emergency contact information is crucial in case of unexpected situations during travel. Providing the correct contact details ensures that authorities can reach out to designated individuals in case of emergencies, adding an extra layer of safety and security.

Comparing Renters Insurance Quotes

When it comes to comparing renters insurance quotes, it’s essential to take the time to research online and request quotes directly from insurance companies. This process allows you to evaluate different options and find the best coverage that fits your needs and budget.

Reviewing Coverage Details

- Always review the coverage details along with the quoted prices to ensure that the policy offers adequate protection for your belongings and liability.

- Pay attention to specifics such as coverage limits, deductibles, additional benefits, and any exclusions that may affect your decision.

- Consider your individual needs and preferences to choose a policy that provides the right level of coverage for your situation.

Evaluating Reputation and Customer Service

- Check online reviews and ratings from independent agencies like J.D. Power to evaluate the reputation and customer service of insurance companies.

- Contact the insurance providers directly to ask questions about their services, claims process, and overall customer experience.

- Consider the responsiveness and helpfulness of the insurance companies when making inquiries to gauge their level of customer service.

Creating a Comparison Table

| Insurance Provider | Coverage Limits | Deductibles | Additional Benefits | Customer Reviews |

|---|---|---|---|---|

| Provider A | $30,000 | $500 | Rental Reimbursement | 4.5/5 |

| Provider B | $40,000 | $750 | Identity Theft Protection | 4.2/5 |

| Provider C | $25,000 | $1,000 | Personal Property Replacement | 4.8/5 |

Understanding Discounts and Savings

When it comes to renters insurance, understanding the discounts and savings offered by insurance companies can help you lower your insurance costs significantly. By taking advantage of these discounts, you can ensure that you are getting the best deal possible while still maintaining adequate coverage.

Common Discounts Offered

- Multi-Policy Discount: Insuring your renters insurance with the same company that provides your auto or life insurance can often lead to a discount on your premiums.

- Security Systems Discount: Installing security features such as smoke detectors, burglar alarms, or deadbolt locks in your rental property can make you eligible for lower insurance rates.

- Good Credit Discount: Maintaining a good credit score can also help you save on renters insurance, as insurance companies often consider individuals with good credit to be less risky to insure.

Maximizing Discounts for Savings

- Bundle Your Policies: Combining your renters insurance with other policies like auto or life insurance from the same company can lead to significant discounts.

- Improve Security Measures: Investing in additional security measures for your rental property, such as installing a security camera system or a smart lock, can help you qualify for more discounts.

- Maintain Good Credit: Paying bills on time, keeping credit card balances low, and monitoring your credit report regularly can all contribute to maintaining a good credit score and potentially lowering your insurance costs.

Dealing with Special Circumstances

When it comes to renters insurance, special circumstances can play a significant role in determining your quotes. Factors like owning pets or running a home business can impact the coverage options available to you. It’s essential to understand how these unique situations can affect your policy and what steps you can take to customize your coverage accordingly.

Owning Pets and Home Businesses

- Having pets: If you own pets, especially breeds considered high-risk, your renters insurance quotes may be higher due to potential liability risks. Consider obtaining additional liability coverage to protect yourself in case your pet causes damage or harm to others.

- Running a home business: Operating a business from your rented property can also impact your insurance quotes. You may need to secure additional coverage for business equipment, inventory, and liability related to your business activities.

Additional Coverage for Valuables

- Valuables coverage: If you own high-value items such as jewelry, artwork, or collectibles, consider adding a scheduled personal property endorsement to your policy. This will provide extra coverage for specific valuable items that may exceed the standard limits of your renters insurance.

- High-risk items: For items that are considered high-risk, such as firearms or expensive electronics, it’s crucial to discuss these with your insurance provider. You may need to adjust your coverage or add special endorsements to ensure adequate protection.

Customizing Renters Insurance Quotes

- Assessment of unique situations: Work with your insurance agent to assess your individual circumstances and determine the right coverage options for your needs. Provide detailed information about your pets, business operations, or valuable items to customize your policy effectively.

- Policy adjustments: Based on your specific requirements, you can customize your renters insurance policy by adding endorsements, increasing coverage limits, or opting for specialized coverage options tailored to your situation.

Reading and Analyzing Renters Insurance Quotes

When it comes to renters insurance, understanding and analyzing insurance quotes is essential to make an informed decision. A renters insurance quote typically includes various components that outline the coverage and costs associated with the policy.

Components of a Renters Insurance Quote

- Premiums: The amount you pay for the insurance policy, usually on a monthly or annual basis.

- Deductibles: The amount you are required to pay out of pocket before your insurance coverage kicks in.

- Coverage Limits: The maximum amount the insurance company will pay for covered losses.

Interpreting Renters Insurance Quotes

- Review the premium amount to understand the cost of the policy.

- Consider the deductible and choose a level that aligns with your budget and needs.

- Check the coverage limits to ensure they meet your requirements for protection.

Analyzing Renters Insurance Quotes

- Compare quotes from different insurance providers to find the best coverage at a competitive price.

- Look for any additional coverage options or endorsements that may be beneficial for your specific situation.

- Understand any exclusions or limitations in the policy to avoid surprises in the event of a claim.

Importance of Customer Reviews

Customer reviews play a crucial role in evaluating insurance providers before obtaining quotes. They provide valuable insights into the experiences of existing policyholders and help potential customers make informed decisions when choosing renters insurance.

Using Customer Reviews Effectively

Customer reviews offer a wealth of information that can guide individuals in selecting the right renters insurance policy. Here are some key points to consider when utilizing customer feedback:

- Look for Consistent Feedback: Pay attention to recurring themes in the reviews, whether positive or negative, to get a sense of common experiences shared by policyholders.

- Consider Overall Ratings: Take into account the overall ratings given by customers, as they can indicate the level of satisfaction with the insurance provider.

- Read Detailed Reviews: Dive deeper into individual reviews to understand specific experiences and scenarios that may be relevant to your own insurance needs.

- Check for Response to Feedback: See if the insurance provider responds to customer reviews, especially negative ones, as it demonstrates a commitment to customer service and satisfaction.

Navigating the Online Quote Process

When obtaining renters insurance quotes online, there are several steps involved to ensure accuracy and maximize available discounts. Utilizing online tools can provide convenience and benefits when comparing quotes from multiple providers.

Entering Accurate Information

- Start by providing correct personal details such as your name, address, and contact information to receive accurate quotes.

- Be specific about the coverage you need, including the value of your belongings and any additional coverage options required.

- Ensure you accurately report any safety features in your rental property, as this can impact the cost of your insurance.

Maximizing Available Discounts

- Look for discounts based on factors like having a security system, being a non-smoker, or bundling your renters insurance with other policies.

- Provide information about any memberships or affiliations you have that may qualify you for discounts, such as being a member of a professional organization.

- Consider increasing your deductible to lower your premium, but make sure it’s an amount you can afford in the event of a claim.

Benefits of Using Online Tools

- Online tools allow you to easily compare quotes from multiple insurance providers, helping you find the best coverage at the most competitive price.

- You can adjust coverage options and see real-time changes in premiums, making it easier to customize a policy that fits your needs and budget.

- Accessing quotes online saves time and effort compared to contacting individual insurance companies separately, streamlining the process of finding the right renters insurance policy.

Seeking Professional Guidance

When it comes to navigating the complex world of renters insurance, seeking professional guidance from an insurance agent or broker can be extremely beneficial. These experts have in-depth knowledge of the insurance industry and can provide valuable insights to help you make informed decisions about your coverage options.

Advantages of Consulting with an Insurance Professional

- Insurance agents or brokers can review your specific needs and recommend appropriate coverage options tailored to your situation.

- They can explain complex insurance terms and jargon in a way that is easy to understand, ensuring you are fully aware of what your policy covers.

- Insurance professionals can help you identify any gaps in your coverage and suggest additional policies or endorsements to ensure you are adequately protected.

Finding a Reliable Insurance Professional

When looking for an insurance agent or broker to assist with your renters insurance needs, consider the following tips:

- Seek recommendations from friends, family, or colleagues who have had positive experiences with insurance professionals.

- Verify the credentials and reputation of the insurance agent or broker by checking online reviews and industry certifications.

- Schedule consultations with multiple insurance professionals to compare their expertise, communication style, and proposed coverage options.

Comparison Table of Coverage Options and Costs

| Insurance Professional | Coverage Options | Cost |

|---|---|---|

| Agent A | Basic Coverage, Personal Property Protection, Liability Coverage | $300/year |

| Broker B | Enhanced Coverage, Valuable Items Endorsement, Loss of Use Protection | $400/year |

| Agent C | Comprehensive Coverage, Identity Theft Protection, Renters’ Legal Liability | $350/year |

Scheduling Appointments with Insurance Professionals

- Research and shortlist insurance agents or brokers based on recommendations and reviews.

- Contact the selected professionals to inquire about their availability for consultations.

- Schedule appointments at convenient times to discuss your renters insurance needs and review potential policies.

- Come prepared with questions and information about your rental property to make the most of the consultation.

Understanding Policy Exclusions

When getting renters insurance quotes, it’s crucial to understand the policy exclusions that could impact your coverage. Policy exclusions are specific situations or items that are not covered by the standard renters insurance policy. Reviewing these exclusions helps you understand the limitations of your coverage and avoid surprises when making a claim.

Common Exclusions in Renters Insurance Policies

- Damage from floods or earthquakes: Standard renters insurance policies typically do not cover damage caused by floods or earthquakes. Additional coverage may be required for these natural disasters.

- High-value items: Certain expensive items like jewelry, art, or collectibles may have limited coverage under a standard policy. Additional coverage, known as a rider or endorsement, may be needed to fully protect these items.

- Intentional damage or illegal activities: Any damage caused intentionally or as a result of illegal activities will not be covered by renters insurance.

Importance of Reviewing Policy Exclusions

- Understanding policy exclusions helps you manage your expectations regarding what is and isn’t covered by your renters insurance.

- By knowing the exclusions, you can make informed decisions about whether additional coverage is necessary for specific risks.

- Reviewing policy exclusions can prevent misunderstandings and ensure you have the right coverage in place when you need it.

Examples of Situations Not Covered by Standard Renters Insurance Policies

- Damage from pests like bedbugs or rodents

- Natural wear and tear of personal belongings

- Loss of valuable items due to negligence or carelessness

Last Point

In conclusion, renters insurance quotes play a crucial role in safeguarding your assets. By following the tips and information provided, you can navigate the process with confidence and ensure adequate coverage for your rental property.