Car Insurance Michigan: Everything You Need To Know About Coverage

Car insurance Michigan is a crucial aspect of protecting yourself on the road. From understanding coverage options to navigating the unique laws in the state, this guide dives deep into all things car insurance.

Whether you’re a new driver or a long-time resident, having the right car insurance in Michigan can make all the difference in times of need.

Overview of Car Insurance in Michigan

Car insurance is a vital component of owning and operating a vehicle in Michigan. It provides financial protection in case of accidents, theft, or damage to your vehicle, as well as liability coverage for injuries or property damage you may cause to others.

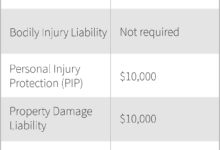

Minimum Car Insurance Requirements in Michigan

- Michigan law requires drivers to carry no-fault auto insurance, which includes:

- Personal Injury Protection (PIP) coverage for medical expenses, lost wages, and other related costs.

- Property Protection Insurance (PPI) to cover up to $1 million in property damage caused by your vehicle in Michigan.

- Residual Bodily Injury and Property Damage Liability Insurance to cover costs if you are sued due to an accident in another state.

Factors Influencing Car Insurance Rates in Michigan

The cost of car insurance in Michigan can be influenced by various factors, including:

- Driving record: A history of accidents or traffic violations can lead to higher premiums.

- Age and gender: Younger drivers and males typically pay more for insurance.

- Location: Urban areas with higher crime rates may have higher insurance rates.

- Type of vehicle: The make, model, and age of your car can impact insurance costs.

- Coverage limits: Higher coverage limits and additional optional coverages can increase premiums.

Types of Car Insurance Coverage in Michigan

When it comes to car insurance coverage in Michigan, there are several types available to protect you in different situations.

Personal Injury Protection (PIP)

- Provides coverage for medical expenses, lost wages, and other related costs for you and your passengers in the event of an accident, regardless of fault.

- PIP is a mandatory coverage in Michigan, known for its “no-fault” system.

- Typical coverage limits range from $250,000 to unlimited.

Property Protection Insurance (PPI)

- Covers up to $1 million in property damage caused by your vehicle in Michigan.

- PPI is also a mandatory coverage in the state.

- Deductibles for PPI can vary, depending on the insurance provider.

Residual Liability Insurance

- Provides coverage for bodily injury and property damage you may cause to others in an accident.

- Minimum liability coverage limits in Michigan are $20,000 for bodily injury per person, $40,000 for bodily injury per accident, and $10,000 for property damage.

- Deductibles for liability insurance can also vary based on the policy.

Comparison of Coverage Types

| Insurance Coverage | Coverage Limits | Deductibles | Typical Cost Range |

|---|---|---|---|

| Personal Injury Protection (PIP) | $250,000 to Unlimited | Varies | $100 to $300 per vehicle annually |

| Property Protection Insurance (PPI) | Up to $1 million | Varies | $50 to $200 per vehicle annually |

| Residual Liability Insurance | $20,000/$40,000/$10,000 | Varies | $200 to $500 per vehicle annually |

No-Fault Car Insurance System in Michigan

In Michigan, the no-fault car insurance system is a unique approach that requires each driver to carry their insurance to cover their own medical expenses and other related costs in the event of an accident, regardless of who was at fault.

How the No-Fault System Works in Michigan

The no-fault system in Michigan means that insurance companies compensate their policyholders for medical expenses, lost wages, and other accident-related costs, regardless of who caused the accident. This system aims to provide prompt payment and avoid lengthy legal battles to determine fault.

Advantages and Disadvantages of the No-Fault System

– Advantages:

– Quick payment of medical expenses

– Reduced litigation

– Coverage for passengers without insurance

– Disadvantages:

– Potentially higher premiums

– Limited ability to sue for non-economic damages

Personal Injury Protection (PIP) Coverage in Michigan

Personal Injury Protection (PIP) coverage is mandatory in Michigan and helps pay for medical expenses, lost wages, and essential services if you are injured in an auto accident, regardless of fault.

Filing a Claim Under the No-Fault System

To file a claim under the no-fault system in Michigan, you must notify your insurance company promptly and provide all necessary documentation, such as medical bills and proof of lost wages.

Situations Where the No-Fault System Applies

The no-fault system applies in most car accidents in Michigan, except in cases involving out-of-state drivers or in accidents that result in serious injuries meeting specific criteria.

Cost of Premiums for No-Fault Car Insurance vs. Traditional Liability Insurance

Premiums for no-fault car insurance in Michigan are generally higher than traditional liability insurance due to the increased coverage provided under the no-fault system.

Choosing the Right Coverage Limits for PIP in Michigan

When selecting coverage limits for Personal Injury Protection (PIP) in Michigan, consider factors such as your health insurance coverage, budget, and potential out-of-pocket expenses in case of an accident.

Impact of the No-Fault System on Insurance Fraud Rates

The no-fault system in Michigan has been associated with higher insurance fraud rates due to the potential for abuse in claiming benefits. Insurance companies have implemented measures to combat fraud and protect against false claims.

Cost Factors Affecting Car Insurance in Michigan

When it comes to car insurance in Michigan, several key factors can significantly impact insurance premiums. Factors such as age, driving record, location, and credit score all play a crucial role in determining how much you pay for car insurance coverage in the state.

Age

Age is a significant factor that insurance companies consider when calculating car insurance rates in Michigan. Younger drivers, especially those under the age of 25, typically pay higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers, particularly those over the age of 65, may also face higher rates due to potential health issues that could impact their driving abilities.

Driving Record

Your driving record is another important factor that affects car insurance costs in Michigan. Drivers with a clean record, meaning no accidents or traffic violations, are usually eligible for lower insurance rates. However, drivers with a history of accidents, tickets, or DUI convictions may face higher premiums as they are considered higher-risk individuals by insurance companies.

Location

Where you live in Michigan can also impact your car insurance rates. Urban areas with higher traffic congestion and crime rates tend to have higher insurance premiums compared to rural areas. Additionally, factors such as weather conditions, road infrastructure, and the frequency of car thefts in your area can also influence how much you pay for car insurance coverage.

Credit Score

In Michigan, your credit score can also affect your car insurance rates. Insurance companies often use credit-based insurance scores to determine a driver’s likelihood of filing a claim. Drivers with higher credit scores are typically viewed as more responsible and are rewarded with lower insurance premiums. On the other hand, individuals with lower credit scores may face higher rates as they are perceived as higher-risk policyholders.

Car Insurance Laws and Regulations in Michigan

In Michigan, car insurance laws and regulations play a crucial role in ensuring that drivers have the necessary coverage to protect themselves and others in the event of an accident. Understanding the minimum requirements, the unique “no-fault” system, and the process for filing claims is essential for all drivers in the state.

Minimum Car Insurance Requirements in Michigan

Michigan law mandates specific minimum car insurance requirements for all drivers. These include:

- Bodily Injury Liability: $50,000 per person and $100,000 per accident

- Property Damage Liability: $10,000 per accident

- Personal Injury Protection (PIP): Unlimited medical and rehabilitation benefits

Impact of Michigan’s No-Fault Insurance System

Michigan operates under a unique “no-fault” insurance system, meaning that each driver’s insurance company covers their own medical expenses regardless of who is at fault in an accident. This system can impact car insurance policies and claims processing by reducing the need for lengthy legal battles to determine fault.

Filing a Claim with the Michigan Department of Insurance and Financial Services

In case of disputes with an insurance provider, drivers in Michigan can file a claim with the Michigan Department of Insurance and Financial Services. The department assists in resolving conflicts and ensuring that drivers receive fair treatment from their insurance companies.

Implications of Michigan’s “Mini-Tort” Law

Michigan’s “mini-tort” law allows drivers to sue for up to $1,000 in property damage not covered by insurance in minor accidents. This law can impact car insurance coverage and claims, especially for damages below the minimum property damage liability limit.

Comparison with Neighboring States

When comparing Michigan’s insurance laws with neighboring states like Ohio and Illinois, key differences emerge. For example, Ohio follows a traditional fault-based system, while Illinois also operates under a no-fault system but with different coverage limits. These differences can affect residents or drivers passing through the region and highlight the importance of understanding each state’s laws.

Discounts and Savings on Car Insurance in Michigan

When it comes to car insurance in Michigan, there are various discounts and savings opportunities available that can help you lower your premiums and save money. Understanding these discounts and how to maximize savings can make a significant difference in your overall insurance costs.

Common Discounts Offered by Car Insurance Companies in Michigan

- Multi-vehicle discount

- Good driver discount

- Safety feature discount

- Low mileage discount

- Good student discount

How Bundling Policies Can Help Save on Car Insurance Premiums

One effective way to save on car insurance in Michigan is by bundling multiple insurance policies with the same company. By combining your auto insurance with other policies such as home or renters insurance, you can often receive a discount on your premiums for each policy.

Strategies for Maximizing Savings on Car Insurance in Michigan

- Compare quotes from multiple insurance companies to find the best rate.

- Take advantage of discounts for safe driving habits, good credit, or loyalty to a specific insurer.

- Consider raising your deductibles to lower your premiums, but make sure you can afford the out-of-pocket costs if you need to make a claim.

- Maintain a clean driving record to qualify for lower rates and avoid surcharges.

- Inquire about special programs or discounts for certain professions, affiliations, or memberships.

Best Car Insurance Companies in Michigan

When it comes to choosing the best car insurance company in Michigan, it’s essential to consider factors such as coverage options, rates, customer service, and overall satisfaction. Analyzing customer reviews and ratings can provide valuable insights into how insurance providers handle claims and interact with their policyholders.

Comparison of Top Car Insurance Companies in Michigan

In Michigan, there are several top car insurance companies that stand out for their coverage options, rates, and customer service. Let’s take a detailed look at three leading insurance providers in the state:

| Insurance Company | Coverage Options | Premium Rates | Customer Support |

|---|---|---|---|

| Company A | Comprehensive, Collision, Liability | Competitive rates with discounts | 24/7 customer service, online claims |

| Company B | Basic, Additional Coverage Add-Ons | Affordable rates for all drivers | Personalized customer support |

| Company C | Full Coverage, Roadside Assistance | Higher premiums but extensive coverage | Dedicated claims handling team |

Each of these insurance companies has its strengths and weaknesses based on factors like financial stability, available discounts, and customer satisfaction. By comparing their coverage options, premium rates, and customer support, you can make an informed decision when selecting the best car insurance company in Michigan.

Steps to File a Car Insurance Claim in Michigan

When it comes to filing a car insurance claim in Michigan, it’s important to follow the proper steps to ensure a smooth process. From documenting the accident to understanding what to expect during the claims process, here is a guide to help policyholders navigate through filing a car insurance claim in Michigan.

Documenting and Reporting an Accident

- Immediately after an accident, check for injuries and call 911 if needed.

- Exchange information with the other driver(s) involved, including names, contact details, and insurance information.

- Take photos of the accident scene, damage to vehicles, and any relevant road signs or signals.

- File a police report and obtain a copy for your records.

- Contact your insurance company to report the accident and initiate the claims process.

Expectations During the Claims Process

- After filing a claim, an adjuster from your insurance company will be assigned to your case.

- The adjuster will investigate the accident, review the damages, and determine the coverage under your policy.

- You may be required to provide additional documentation, such as repair estimates or medical bills.

- Once the investigation is complete, the adjuster will provide a settlement offer based on the policy terms and coverage.

- If you disagree with the settlement offer, you have the right to negotiate or seek legal advice.

Car Insurance Coverage for High-Risk Drivers in Michigan

High-risk drivers in Michigan are classified based on factors such as a history of accidents, traffic violations, DUI convictions, or poor credit scores. These drivers are considered riskier to insure due to their increased likelihood of filing claims.

Factors that Classify Drivers as High-Risk in Michigan

- Past accidents or traffic violations

- DUI convictions

- Poor credit scores

- Youthful or inexperienced drivers

How High-Risk Drivers Can Obtain Car Insurance Coverage in Michigan

- High-risk drivers in Michigan can still obtain car insurance coverage through assigned risk plans or non-standard insurance companies that specialize in providing coverage to high-risk individuals.

- Assigned risk plans are state-mandated programs that ensure all drivers have access to insurance, even if traditional insurers refuse coverage.

- Non-standard insurance companies may offer coverage to high-risk drivers, but premiums are typically higher to offset the increased risk.

Tips for High-Risk Drivers to Lower Their Insurance Premiums

- Improve your driving record by avoiding accidents and traffic violations.

- Take defensive driving courses to demonstrate your commitment to safe driving.

- Consider raising your deductibles to lower your premiums, but be prepared to pay more out of pocket in the event of a claim.

- Shop around and compare quotes from multiple insurance companies to find the best rate for your coverage needs.

Car Insurance Requirements for Teen Drivers in Michigan

Teen drivers in Michigan have specific car insurance requirements that must be met to ensure they are properly covered on the road. Here are the key points to consider when it comes to car insurance for teen drivers in Michigan:

Car Insurance Requirements for Teen Drivers

In Michigan, teen drivers are required to have the same minimum car insurance coverage as any other driver. This includes:

– $50,000 in bodily injury liability per person

– $100,000 in bodily injury liability per accident

– $10,000 in property damage liability

– Personal Injury Protection (PIP) coverage

Impact on Insurance Rates

Adding a teen driver to an existing policy can significantly increase insurance rates due to their lack of driving experience and higher risk of accidents. Parents should be prepared for potential rate hikes when adding a teen driver to their policy.

Finding Affordable Insurance for Teen Drivers

To find affordable car insurance for teen drivers in Michigan, parents can:

– Compare quotes from multiple insurance providers

– Look for discounts specifically for teen drivers

– Consider enrolling their teen in defensive driving courses

Comparison of Insurance Rates

| Insurance Provider | Annual Premium for Teen Driver |

|---|---|

| Provider A | $X |

| Provider B | $Y |

| Provider C | $Z |

Common Discounts for Teen Drivers

– Good student discount

– Driver training discount

– Multi-vehicle discount

– Safe driving discount

Enrolling in Defensive Driving Courses

Parents can help reduce insurance premiums for their teen drivers by enrolling them in defensive driving courses. These courses can help teens improve their driving skills and demonstrate responsibility on the road, potentially leading to lower insurance costs.

Penalties for Driving Without Insurance in Michigan

Driving without insurance in Michigan can lead to serious consequences. Not only is it against the law, but it can also result in hefty fines, license suspension, and other penalties. It is essential for drivers in Michigan to have valid car insurance to avoid these repercussions.

Consequences of Driving Without Insurance in Michigan

- Drivers caught without proof of insurance in Michigan may face fines ranging from $200 to $500 for a first offense.

- Subsequent offenses can result in fines of up to $1,000, as well as potential vehicle impoundment.

- License suspension is also a possibility for drivers found to be driving without insurance in Michigan.

- In addition to fines and license suspension, drivers may also be required to file an SR-22 form to prove financial responsibility before their driving privileges can be reinstated.

Reinstating Driving Privileges After Lapse in Insurance Coverage

- Drivers in Michigan who have had their license suspended due to driving without insurance will need to obtain valid car insurance and provide proof of coverage to the Department of State.

- Once proof of insurance is provided, along with any necessary fees or fines paid, drivers can begin the process of reinstating their driving privileges.

- It is essential for drivers to maintain continuous car insurance coverage to avoid further penalties and ensure compliance with Michigan’s insurance laws.

Car Insurance Options for Electric Vehicles in Michigan

Electric vehicles (EVs) are becoming increasingly popular in Michigan, prompting the need for specialized car insurance options tailored to these eco-friendly vehicles. Insuring an electric car in Michigan follows a similar process to insuring a traditional combustion engine vehicle, but there are certain factors to consider that may impact insurance rates and coverage options.

Process of Obtaining Car Insurance for Electric Vehicles in Michigan

When insuring an electric vehicle in Michigan, drivers can reach out to their preferred insurance companies or agents to inquire about specific coverage options for EVs. Insurance providers may offer specialized policies that cater to the unique needs of electric cars, such as coverage for the vehicle’s battery and charging equipment.

Factors Impacting Insurance Rates for Electric Cars in Michigan

Several factors can influence insurance rates for electric vehicles in Michigan, including the vehicle’s make and model, driving history of the policyholder, annual mileage, and the cost of repairs for EVs. Additionally, the availability of charging stations and the overall safety ratings of electric cars may also impact insurance premiums.

Detailed Comparison of Coverage Options between Traditional and Electric Vehicles in Michigan

When comparing coverage options for traditional combustion engine vehicles and electric cars in Michigan, policyholders may find differences in coverage related to the battery, charging equipment, and specialized repair requirements for EVs. While some insurance companies offer similar coverage for both types of vehicles, others may provide additional benefits specifically for electric cars.

| Insurance Company | Specialized Coverage for Electric Vehicles |

|---|---|

| ABC Insurance | Comprehensive battery coverage |

| XYZ Insurance | Enhanced roadside assistance for EVs |

An insurance expert in Michigan states, “Insuring an electric vehicle in the state not only promotes sustainability but also offers potential cost savings and specialized coverage options that cater to the unique needs of EV owners.”

Understanding Car Insurance Deductibles in Michigan

Car insurance deductibles in Michigan play a crucial role in determining the out-of-pocket expenses you will incur in case of an insurance claim. Understanding the specific laws and regulations regarding deductibles is essential to make informed decisions when selecting your coverage.

Laws and Regulations on Car Insurance Deductibles in Michigan

In Michigan, car insurance deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in to cover the rest of the claim. The state does not have specific laws dictating the exact deductible amounts, allowing flexibility for individuals to choose their preferred levels. However, insurance companies must clearly outline deductible options and costs in the policy documents.

Factors Influencing Car Insurance Premiums in Michigan

Various factors can influence the cost of car insurance premiums in Michigan, including the chosen deductible amount. Generally, opting for a higher deductible can lower your premium since you agree to pay more in case of a claim. Factors such as age, driving record, vehicle type, and location also impact premium costs.

Impact of Different Deductible Amounts on Out-of-Pocket Expenses

To illustrate how deductible amounts can impact out-of-pocket expenses, consider the following scenario:

– A policy with a $500 deductible may have a lower premium but require a higher upfront payment in case of a claim.

– Conversely, a policy with a $1,000 deductible may result in a slightly higher premium but lower out-of-pocket costs during a claim.

Comparison Table of Average Premium Costs with Various Deductible Levels

| Deductible Amount | Average Premium Cost |

|---|---|

| $500 | $1,200 |

| $1,000 | $1,100 |

| $1,500 | $1,000 |

Unique Features in Car Insurance Deductibles in Michigan

Michigan may offer unique features such as deductible waivers, which allow for certain exceptions where the deductible does not apply. Additionally, some policies may include diminishing deductibles, where the deductible decreases over time if no claims are made.

Car Insurance Coverage for Rental Cars in Michigan

When it comes to renting a car in Michigan, understanding the options for insurance coverage is essential to ensure you are adequately protected in case of an accident or damage to the rental vehicle.

Rental car insurance coverage differs from regular auto insurance in that it is specifically designed to cover the rental vehicle while you are using it. This type of coverage typically includes collision damage waivers, liability coverage, and personal accident insurance.

Options for Insuring Rental Cars in Michigan

- Collision Damage Waiver (CDW): This option covers damage to the rental car in case of a collision.

- Liability Coverage: Provides coverage for damage to other vehicles or property in case of an accident.

- Personal Accident Insurance: Covers medical expenses for you and your passengers in case of an accident.

Is Rental Car Insurance Necessary in Michigan?

In Michigan, rental car insurance is not mandatory by law. However, it is highly recommended to consider purchasing coverage from the rental car company or through your own auto insurance policy to avoid potential financial liabilities in case of an accident.

Benefits of Rental Car Insurance Coverage

- Peace of mind knowing you are protected while driving a rental car.

- Avoid potential out-of-pocket expenses for damages or accidents.

- Quick and easy claims process in case of an incident.

Tips for Finding Affordable Car Insurance in Michigan

Finding affordable car insurance in Michigan is crucial for all drivers looking to save money without compromising on coverage. Here are some strategies and tips to help you navigate the process:

Comparing Multiple Quotes for the Best Rates

- Requesting quotes from several insurance providers allows you to compare rates and coverage options to find the most affordable policy.

- Consider factors like deductibles, coverage limits, and discounts offered by each provider when comparing quotes.

Lowering Premiums Without Sacrificing Coverage

- Opt for a higher deductible to lower your premium, but make sure you have enough savings to cover the deductible in case of an accident.

- Take advantage of discounts for safe driving, bundling policies, or having anti-theft devices installed in your vehicle.

Factors Affecting Car Insurance Rates in Michigan

- Your driving record, age, credit score, and the area where you live can all impact your car insurance rates in Michigan.

- You may qualify for lower rates if you have a clean driving record, are a mature driver, or live in a less congested area.

Requesting and Comparing Online Quotes

- Visit the websites of insurance providers to request quotes online by providing relevant information about your driving history and vehicle.

- Compare the quotes you receive, ensuring you understand the coverage offered and any exclusions that may apply.

Comparison Table of Coverage Options and Premiums

| Insurance Company | Coverage Options | Premiums |

|---|---|---|

| Company A | Comprehensive, Collision, Liability | $XXX |

| Company B | Liability, Personal Injury Protection | $XXX |

| Company C | Collision, Uninsured Motorist | $XXX |

Specific Discounts for Michigan Residents

- Michigan residents may be eligible for discounts such as multi-policy discounts, safe driver discounts, or discounts for completing defensive driving courses.

- Explore all available discounts to maximize your savings on car insurance premiums.

Customizing Your Policy to Fit Your Needs

- Work with your insurance agent to tailor a policy that meets your specific coverage needs while staying within your budget constraints.

- Consider adding or removing coverage options based on your driving habits and financial situation.

Ultimate Conclusion

In conclusion, car insurance in Michigan is not just a legal requirement but a safety net that ensures you’re covered in any situation. Remember to explore your options, compare rates, and choose the best policy that suits your needs. Stay safe on the road!