Car Insurance Comparison: Finding The Best Coverage And Savings

Starting with car insurance comparison, this article delves into the importance of finding the best coverage while saving money in the process.

We will explore key factors to consider, types of coverage, online tools available, tips for evaluating insurance quotes, and common mistakes to avoid.

Importance of Car Insurance Comparison

When it comes to protecting your vehicle and finances, comparing car insurance policies is essential to ensure you find the best coverage that meets your needs. By exploring different options, individuals can make informed decisions that can lead to significant cost savings in the long run.

Comparing Insurance Options for Cost Savings

By comparing multiple car insurance policies, individuals can identify the most cost-effective option that provides adequate coverage. For example, Policy A may offer lower premiums but higher deductibles, while Policy B may have higher premiums but more comprehensive coverage. This comparison allows consumers to choose a policy that aligns with their budget and coverage requirements.

| Insurance Policy | Premiums | Deductibles | Coverage |

|---|---|---|---|

| Policy A | Low | High | Basic |

| Policy B | High | Low | Comprehensive |

| Policy C | Medium | Medium | Customizable |

Policy A offers affordable premiums with higher deductibles, suitable for individuals looking for basic coverage. Policy B provides comprehensive coverage with higher premiums but lower deductibles for those seeking extensive protection. Policy C offers customizable options for individuals who want to tailor their coverage to specific needs.

Factors to Consider When Comparing Car Insurance

When comparing car insurance, it is essential to carefully evaluate various factors to ensure you choose the best coverage for your needs. Here are some key factors to consider:

Coverage Types

Different insurance providers offer varying types of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist. It is crucial to assess your individual requirements and select a policy that provides adequate protection for your vehicle.

Deductibles

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your premiums, but it means you will have to pay more in the event of a claim. Consider your financial situation and risk tolerance when choosing a deductible.

Premiums

Premiums are the amount you pay for your insurance coverage. It is important to compare premiums from different providers to ensure you are getting a competitive rate. Be sure to consider the value you are receiving for the price you pay.

Discounts

Many insurance companies offer discounts for various factors, such as safe driving records, bundled policies, and vehicle safety features. Be sure to inquire about available discounts as they can significantly impact the final premium you pay.

Reputation and Financial Stability

The reputation and financial stability of an insurance provider are crucial considerations. You want to choose a company with a strong track record of customer service and a solid financial standing to ensure they can fulfill their obligations in the event of a claim.

Personal Driving Habits and Vehicle Details

Your personal driving habits, such as mileage and driving history, as well as details about your vehicle, can affect your insurance comparison. Providers may offer different rates based on these factors, so it is important to provide accurate information.

Comparative Table of Coverage Types

| Insurance Provider | Liability | Collision | Comprehensive |

|---|---|---|---|

| Provider A | ✓ | ✓ | ✓ |

| Provider B | ✓ | ✓ | ✓ |

Deductibles play a significant role in determining the overall cost of your insurance policy. Choosing a higher deductible can lead to lower premiums, but be prepared to pay more out of pocket in the event of a claim.

Financial Stability Evaluation

It is important to assess the financial stability of insurance providers to ensure they can meet their financial obligations. Look at factors such as credit ratings and industry rankings to gauge the stability of the company.

Customer Reviews and Ratings

Before selecting an insurance company, take the time to review customer feedback and ratings. This can provide valuable insights into the quality of service, claims processing, and overall customer satisfaction with the provider.

Types of Car Insurance Coverage for Comparison

When comparing car insurance coverage options, it’s essential to understand the different types available and their benefits and drawbacks for various driver profiles.

Liability Coverage

Liability coverage is required in most states and helps cover costs if you’re at fault in an accident that causes injury or property damage to others. It does not cover your own vehicle damage.

- Benefits: Protects you from financial ruin in case of a major accident.

- Drawbacks: Limited coverage for your own vehicle damage.

Comprehensive Coverage

Comprehensive coverage helps pay for damage to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Benefits: Offers broader protection for your vehicle.

- Drawbacks: Higher premiums compared to liability-only coverage.

Collision Coverage

Collision coverage pays for damage to your vehicle in a collision with another vehicle or object.

- Benefits: Helps repair or replace your vehicle after an accident.

- Drawbacks: Can be costly, especially for newer vehicles.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re in an accident caused by a driver with insufficient or no insurance.

- Benefits: Ensures coverage even if the at-fault driver is uninsured.

- Drawbacks: Adds to premium costs.

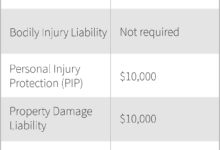

Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers regardless of fault in an accident.

- Benefits: Provides quick access to medical coverage without determining fault.

- Drawbacks: May not be necessary if you have good health insurance.

Understanding the specific needs of individual drivers is crucial when selecting the appropriate coverage.

Online Tools for Car Insurance Comparison

When it comes to finding the best car insurance policy that suits your needs and budget, utilizing online tools for comparison can be extremely beneficial. These platforms make it easier for you to compare multiple insurance quotes from different providers all in one place.

Popular Websites for Car Insurance Comparison

There are several popular websites and platforms that offer car insurance comparison services. Some of the most commonly used ones include:

- Insurify

- The Zebra

- Compare.com

- NerdWallet

How Online Tools Simplify the Comparison Process

Online tools streamline the process of comparing car insurance quotes by allowing you to input your information once and receive multiple quotes from various insurance companies. This saves you time and effort that would have been spent contacting each provider individually.

Tips for Using Online Comparison Tools Effectively

- Provide accurate information: Make sure to enter correct details about your vehicle, driving history, and coverage needs to get accurate quotes.

- Compare coverage options: Look beyond the price and compare the coverage options offered by each insurance provider to ensure you are getting the protection you need.

- Check for discounts: Many online tools also highlight potential discounts you may be eligible for, so be sure to take advantage of these savings opportunities.

- Read reviews: Before making a decision, read reviews and ratings of the insurance companies to get an idea of their customer service and claims handling.

How to Evaluate Insurance Quotes

When comparing insurance quotes, it is crucial to analyze the details thoroughly to make an informed decision. Here are the steps to effectively evaluate insurance quotes:

Interpreting Policy Details, Exclusions, and Fine Print

- Read through the policy details carefully to understand the coverage provided by each quote.

- Pay close attention to any exclusions mentioned in the policy, as they might impact the protection offered.

- Review the fine print to ensure you are aware of any limitations or conditions that may affect your coverage.

Understanding the Value Offered by Different Insurance Quotes

- Compare the coverage limits and deductibles across different quotes to determine the value offered.

- Consider the reputation and financial stability of the insurance companies providing the quotes.

- Look for any additional benefits or discounts included in the quotes that could add value to your policy.

Saving Money Through Car Insurance Comparison

When it comes to saving money on car insurance, utilizing comparison tools can be a game-changer. By comparing different insurance providers and policies, you can find the best deals that suit your needs and budget.

Strategies for Leveraging Insurance Comparison

One effective strategy is to regularly review and compare quotes from multiple insurance companies. This allows you to stay informed about the current market rates and identify any potential savings opportunities.

- Utilize online comparison tools to easily compare quotes from various insurers.

- Consider bundling your car insurance with other policies, such as home or renters insurance, to qualify for multi-policy discounts.

- Adjust your coverage levels based on your driving habits and needs to potentially lower your premiums.

Negotiation Tactics for Lowering Premiums

After comparing insurance quotes, you can leverage the information to negotiate with your current insurer or potential new providers for better rates.

- Highlight any lower quotes you received from competitors to negotiate a better rate with your current insurer.

- Ask about available discounts and incentives, such as safe driver discounts or pay-as-you-drive programs, to potentially lower your premiums.

- Consider increasing your deductible to lower your premium, but ensure you can afford the out-of-pocket costs in case of an accident.

Bundling Policies for Cost Savings

Bundling your car insurance with other insurance policies, such as home, renters, or life insurance, can lead to significant cost savings.

- Many insurance companies offer discounts for bundling multiple policies, making it a cost-effective option for saving money.

- By consolidating your insurance policies with one provider, you may also simplify your billing and communication processes.

- Review your current insurance policies to see if bundling is a viable option for reducing your overall insurance costs.

Common Mistakes to Avoid in Car Insurance Comparison

When comparing car insurance options, it’s important to steer clear of common mistakes that could impact your coverage and costs. By avoiding these pitfalls, you can make a more informed decision and secure the right insurance for your needs.

Overlooking Hidden Fees or Sacrificing Coverage for Price

Before selecting an insurance policy based solely on the price, it’s crucial to carefully review the coverage and any hidden fees that may not be immediately apparent. Opting for the cheapest option without considering the coverage could leave you vulnerable in the event of an accident or claim.

Importance of Updating Information Accurately

When comparing insurance quotes, it’s essential to provide accurate and up-to-date information to receive the most precise quotes. Failing to update details such as driving history, vehicle information, or personal details can result in inaccurate quotes that may not reflect the actual cost or coverage.

Examples of Errors Impacting Coverage and Costs

Errors in comparison can have significant consequences, such as inadequate coverage or unexpected costs. For instance, providing incorrect mileage or underestimating your annual driving distance could lead to a policy that doesn’t provide enough coverage in case of an accident.

Understanding Policy Details in Car Insurance Comparison

When comparing car insurance policies, it is crucial to delve into the fine print and understand the policy details. This step ensures that you are making an informed decision and selecting the coverage that best suits your needs.

Importance of Reading and Understanding Policy Terms and Conditions

Policy terms and conditions outline the specifics of your coverage, including what is included and excluded. By reading and understanding these details, you can avoid any surprises or misunderstandings in the event of a claim.

Key Elements to Compare: Coverage Limits, Deductibles, and Exclusions

When comparing car insurance policies, pay close attention to key elements such as coverage limits, deductibles, and exclusions. Coverage limits determine the maximum amount the insurance company will pay out for a claim, while deductibles are the amount you must pay out of pocket before your coverage kicks in. Exclusions detail what is not covered by the policy, so be sure to understand these to avoid any gaps in coverage.

Tips on Identifying Gaps in Coverage

- Compare coverage limits across policies to ensure you have adequate protection for your vehicle and assets.

- Review deductibles to see how much you would be responsible for in the event of a claim.

- Check exclusions to understand what situations or items are not covered by each policy.

- Consider additional riders or endorsements to fill any gaps in coverage that may exist.

Benefits of Using an Insurance Broker for Comparison

Insurance brokers play a crucial role in helping individuals navigate the complex world of car insurance and comparing different options. They offer personalized advice and assistance throughout the comparison process, making it easier for consumers to find the right coverage for their needs.

Role of Insurance Brokers

Insurance brokers act as intermediaries between insurance companies and customers, providing expert guidance on available policies and helping individuals understand their options. They have in-depth knowledge of the insurance market and can recommend suitable coverage based on a client’s specific requirements.

Personalized Assistance

Brokers take the time to understand a client’s unique situation, including their driving history, budget, and coverage preferences. This personalized approach allows them to tailor recommendations and present options that align with the individual’s needs, ensuring they make an informed decision when choosing a car insurance policy.

Reasons for Using Brokers

– Expertise: Brokers have extensive knowledge of the insurance industry and can offer valuable insights that may not be readily available to consumers.

– Time-saving: Brokers handle the research, comparison, and negotiation processes on behalf of their clients, saving them time and effort.

– Customized Solutions: Brokers can customize insurance packages to suit a client’s specific requirements, providing a tailored approach to coverage.

– Advocacy: Brokers advocate for their clients in case of claims or disputes, ensuring they receive fair treatment from insurance companies.

Impact of Driving History on Car Insurance Comparison

When comparing car insurance options, your driving history plays a crucial role in determining the premiums and coverage available to you. Insurance companies assess the risk you pose based on past incidents on the road, such as accidents, speeding tickets, or other violations.

Influence of Driving History on Insurance Premiums

Your driving record directly affects the insurance premiums you will be quoted. A clean driving history with no accidents or violations typically leads to lower premiums, as you are considered a lower risk driver. On the other hand, a history of accidents, speeding tickets, or DUIs can result in higher premiums or even difficulty in finding coverage.

- Individual with a clean driving record: Lower premiums due to being perceived as a low-risk driver.

- Individual with one accident: Moderate increase in premiums to reflect higher risk.

- Individual with multiple speeding tickets: Higher premiums and limited coverage options due to increased risk.

Improving your driving history by practicing safe driving habits and attending defensive driving courses can help mitigate the impact of past incidents on your insurance rates.

Special Considerations for High-Risk Drivers in Insurance Comparison

When it comes to high-risk drivers, insurance comparison can be a bit trickier but still essential. High-risk drivers are individuals who have a higher likelihood of being involved in accidents or filing claims based on factors like a poor driving record, young age, or previous insurance lapses. Despite the challenges they may face, high-risk drivers can still find competitive insurance rates by carefully comparing their options and understanding what factors influence their premiums.

Factors Classifying Drivers as High-Risk

- Multiple traffic violations or speeding tickets

- History of accidents or at-fault claims

- DUI (Driving Under the Influence) or DWI (Driving While Intoxicated) convictions

- Lapse in insurance coverage

- Youthful or inexperienced drivers

Navigating Insurance Options for High-Risk Drivers

High-risk drivers should consider specialized insurance companies that cater to their needs. These companies may offer policies tailored to high-risk profiles and provide better rates compared to traditional insurers.

Insurance Coverage for High-Risk Drivers vs. Standard-Risk Drivers

| Coverage | High-Risk Drivers | Standard-Risk Drivers |

|---|---|---|

| Liability Coverage | Higher premiums | Lower premiums |

| Comprehensive Coverage | Limited coverage options | Broader coverage options |

| Collision Coverage | Higher deductibles | Lower deductibles |

Improving Driving Record for Better Rates

High-risk drivers can work on improving their driving record by practicing safe driving habits, attending defensive driving courses, and avoiding traffic violations. Over time, demonstrating responsible driving behavior can help in qualifying for better insurance rates.

Choosing the Right Deductible and Coverage Limits

High-risk drivers should carefully assess their financial situation and risk tolerance when selecting deductibles and coverage limits. Opting for a higher deductible can lower premiums but may result in higher out-of-pocket expenses in the event of a claim. It’s crucial to strike a balance that offers adequate protection without overburdening financially.

Regional Variances in Car Insurance Comparison

When it comes to car insurance comparison, it’s essential to understand how rates and coverage options can vary significantly based on the region or state you reside in. Various factors such as local laws, demographics, and weather conditions play a crucial role in determining insurance comparisons.

Impact of Urban vs. Rural Areas

In urban areas, where population density is higher, insurance premiums tend to be more expensive compared to rural areas. This is mainly due to the increased risk of accidents and theft in densely populated areas. On the other hand, rural areas typically have lower premiums since the risk of accidents is lower.

Role of Traffic Congestion

Traffic congestion in urban areas can also impact insurance costs and coverage availability. Higher congestion levels can lead to more accidents, which may result in higher premiums for drivers in these areas. Insurers take into account the frequency of accidents in a specific area when determining premiums.

Natural Disaster Risk Levels

Certain regions are more prone to natural disasters such as hurricanes, earthquakes, or floods. Insurers consider the risk levels of these disasters when calculating insurance pricing and coverage options. If you live in an area with a high risk of natural disasters, you may expect to pay higher premiums to ensure adequate coverage.

Adjusting Comparison Strategies

When comparing car insurance quotes, it’s crucial to adjust your strategies based on regional variations. Take into account the specific risks associated with your region and consider factors such as crime rates, weather patterns, and the frequency of natural disasters. By tailoring your comparison approach to regional considerations, you can make more informed decisions about your car insurance coverage.

Customer Reviews and Feedback in Car Insurance Comparison

Customer reviews play a crucial role in the process of comparing car insurance providers. They provide valuable insights into the experiences of policyholders and can greatly influence decision-making when choosing an insurance company.

Significance of Customer Reviews

Customer reviews offer real-life feedback on the quality of service, claims processing, customer support, and overall satisfaction with an insurance provider. By reading reviews from actual policyholders, you can gain a better understanding of what to expect and make a more informed decision.

- Customer reviews help in assessing the reliability and trustworthiness of an insurance company.

- They provide insights into the ease of the claims process and the level of customer service.

- Reviews can highlight any common issues or problems faced by policyholders, giving you a clearer picture of potential drawbacks.

Evaluating Credibility of Customer Reviews

When considering customer reviews, it’s important to evaluate their credibility to ensure you are basing your decision on reliable information.

- Look for reviews from verified customers or reputable review platforms to ensure authenticity.

- Consider the overall consensus of reviews rather than focusing on individual opinions.

- Be wary of fake or overly positive reviews that may be misleading.

Technology Trends in Car Insurance Comparison

The advancement of technology has significantly impacted the car insurance comparison landscape, offering new tools and platforms to streamline the process and provide more personalized options for consumers.

Role of AI, Telematics, and Online Platforms

AI (Artificial Intelligence) and telematics play a crucial role in enhancing the comparison experience by analyzing data from various sources to provide accurate quotes based on individual driving behavior. Online platforms offer a convenient way for users to compare different insurance options in one place, saving time and effort.

Impact of Big Data Analytics

Big data analytics enables insurance companies to analyze vast amounts of data to generate personalized insurance quotes tailored to each individual’s risk profile. This data-driven approach ensures that customers receive competitive rates based on their specific circumstances.

Machine Learning Algorithms for Predicting Premiums

Machine learning algorithms are used to predict insurance premiums by analyzing historical data and individual driving behavior. By leveraging these algorithms, insurance companies can offer more accurate pricing based on the unique risk factors of each driver.

Revolutionizing User Interaction with Mobile Apps

Mobile apps have revolutionized the way users interact with insurance comparison tools, providing a user-friendly interface for comparing quotes, managing policies, and filing claims on-the-go. These apps offer convenience and accessibility for consumers seeking car insurance information.

Benefits of Blockchain Technology

Blockchain technology ensures secure and transparent insurance transactions by creating a decentralized and tamper-proof system for storing and sharing data. This technology enhances data security and reduces the risk of fraud in insurance transactions.

Role of Chatbots in Insurance Inquiries

Chatbots are being used to assist users with insurance inquiries and policy comparisons, providing instant answers to common questions and guiding users through the comparison process. These AI-powered chatbots enhance customer service and offer a more interactive experience for consumers.

Legal Considerations in Car Insurance Comparison

When comparing car insurance policies, it is crucial to consider the legal requirements and regulations that impact your decision-making process. Understanding the laws related to insurance can help you make informed choices and ensure compliance with legal standards.

Key Legal Considerations for Car Insurance Comparison

It is essential to be aware of the following legal aspects when comparing car insurance options:

| Legal Considerations | Details |

|---|---|

| Minimum Coverage Requirements | Each state has specific minimum coverage requirements that drivers must meet. Failing to adhere to these requirements can lead to penalties or fines. |

| Penalties for Driving Without Insurance | Driving without insurance can result in severe consequences, such as license suspension, fines, or even vehicle impoundment. |

| Variation of Insurance Laws by Location | Insurance laws can vary significantly from one state to another, impacting the coverage options available and the premiums charged. |

Common Legal Terms in Insurance Policies

Understanding the legal jargon in insurance policies is essential for making informed decisions. Here are some common terms and their implications:

- Deductible: The amount you must pay out of pocket before your insurance coverage kicks in.

- Premium: The price you pay for your insurance coverage, typically on a monthly or annual basis.

- Liability Coverage: Insurance that pays for damages and injuries you cause to others in an accident.

Impact of Legal Regulations on Insurance Comparisons

Legal regulations can significantly impact insurance comparisons, especially concerning factors like a driver’s age or previous driving record. For example, certain states may have laws that impose higher premiums for young or inexperienced drivers.

Epilogue

To sum up, car insurance comparison is a crucial step in securing the right coverage at the best price. By understanding the nuances and utilizing the available tools effectively, individuals can make informed decisions tailored to their specific needs.