Auto Insurance: Everything You Need To Know

Auto insurance plays a crucial role in protecting your vehicle and finances. Understanding the ins and outs of auto insurance is essential for every driver. From coverage options to making claims, here’s a comprehensive guide to help you navigate the world of auto insurance with ease.

Overview of Auto Insurance

Auto insurance plays a crucial role in protecting drivers, passengers, and vehicles on the road. It provides financial coverage in case of accidents or other unexpected events. Let’s delve into the key aspects of auto insurance.

Purpose of Auto Insurance

Auto insurance is designed to provide financial protection to drivers in the event of accidents, theft, or damage to their vehicles. It helps cover repair costs, medical expenses, and liability claims that may arise from a collision or other incidents on the road.

Types of Coverage

– Liability Coverage: Covers the costs associated with injuries or property damage to others in an accident.

– Collision Coverage: Pays for repairs or replacement of your vehicle in case of a collision.

– Comprehensive Coverage: Protects against non-collision incidents like theft, vandalism, or natural disasters.

– Uninsured/Underinsured Motorist Coverage: Covers you if you’re involved in an accident with a driver who has insufficient or no insurance.

Examples of Necessity

Auto insurance is essential in situations such as:

– A car accident where you are at fault and need to cover the other party’s medical expenses.

– Theft or vandalism that results in damage to your vehicle.

– A natural disaster like a flood or fire damaging your car.

Benefits of Auto Insurance

Having auto insurance offers several benefits, including:

– Financial protection against unexpected events that could result in costly repairs or medical bills.

– Compliance with legal requirements in most states to have a minimum level of auto insurance coverage.

– Peace of mind knowing that you are financially safeguarded in case of accidents or other incidents on the road.

Factors Affecting Auto Insurance Rates

When it comes to determining auto insurance rates, several key factors come into play. These factors can greatly impact how much you pay for your car insurance premiums. Let’s delve into the main influences on auto insurance costs.

Age and Driving Experience

Age and driving experience are significant factors that affect auto insurance rates. Generally, younger and less experienced drivers tend to pay higher premiums due to the higher risk associated with their age group. As drivers gain more experience and reach a certain age, insurance rates may decrease.

Vehicle’s Make and Model

The make and model of your vehicle also play a crucial role in determining insurance costs. High-performance cars, luxury vehicles, and models with expensive parts are typically more costly to insure. On the other hand, safer and more affordable cars may result in lower insurance premiums.

Location and Driving Record

Your location and driving record are essential considerations for insurance companies when calculating premiums. Urban areas with higher crime rates and traffic congestion may lead to higher insurance rates. Additionally, a clean driving record with no accidents or traffic violations can help reduce insurance costs significantly.

Types of Auto Insurance Coverage

When it comes to auto insurance, there are several types of coverage options available to protect you and your vehicle in different situations. Understanding the types of coverage can help you choose the right policy that meets your needs and provides adequate protection.

Liability Insurance

Liability insurance is a fundamental type of auto insurance that covers the costs associated with injuries or property damage you cause to others in an accident where you are at fault. It is a legal requirement in most states to have liability insurance to cover the expenses of the other party involved. This coverage helps protect your assets and finances in case you are held responsible for an accident.

Comprehensive Coverage

Comprehensive coverage is an optional insurance type that covers damage to your vehicle caused by incidents other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. It provides protection for a wide range of scenarios that are not covered by collision insurance. Comprehensive coverage is recommended for newer or more expensive vehicles to ensure comprehensive protection.

Collision Coverage

Collision coverage is another optional insurance type that covers the costs of repairing or replacing your vehicle if it is damaged in a collision with another vehicle or object. This coverage is especially important if you have a loan or lease on your vehicle, as it helps cover the expenses of repairing or replacing your car in case of an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you in case you are involved in an accident with a driver who does not have insurance or has insufficient coverage to pay for the damages. This type of coverage helps cover medical expenses, lost wages, and other damages that you may incur due to an accident with an uninsured or underinsured driver. It is recommended to have this coverage to ensure you are protected in such situations.

Choosing the Right Auto Insurance Policy

When it comes to selecting the right auto insurance policy, there are several important factors to consider to ensure you have adequate coverage at a competitive price.

Coverage Limits and Value Assessment

- Assess the value of your vehicle and personal assets to determine appropriate coverage limits.

- Higher value vehicles and greater personal assets may require higher coverage limits to protect against potential losses.

Comparing Quotes from Different Companies

- Obtain quotes from at least three different insurance companies to compare pricing and coverage options.

- Ensure you are getting the best value for your money by exploring multiple options before making a decision.

Understanding Deductibles

- Consider choosing a higher deductible to lower your premiums, but be prepared for higher out-of-pocket costs in the event of a claim.

- Balance the cost savings of a higher deductible with your financial ability to cover the deductible if needed.

Additional Coverage Options

- Explore additional coverage options like roadside assistance and rental car reimbursement for added protection.

- Understand the benefits of these options and compare the costs across different insurance providers.

Comparison Table of Coverage Options

| Insurance Provider | Basic Coverage | Roadside Assistance | Rental Car Reimbursement |

|---|---|---|---|

| Provider A | $500 deductible | $5/month | $30/day |

| Provider B | $750 deductible | $7/month | $25/day |

| Provider C | $1000 deductible | $10/month | $35/day |

Making Auto Insurance Claims

When it comes to making auto insurance claims, understanding the process and being prepared can make a significant difference in getting your vehicle back on the road quickly. From documenting the incident to working with insurance adjusters, each step plays a crucial role in the claims settlement process.

Filing an Auto Insurance Claim

- Document the incident: Take photos of the damage, gather witness information, and file a police report if necessary.

- Contact the insurance company: Notify your insurance provider as soon as possible to initiate the claims process.

- Provide necessary information: Be ready to share details about the incident, including the date, time, and location.

Getting a Vehicle Repaired After an Accident

- Obtain repair estimates: Get multiple quotes from approved repair shops to compare costs and services.

- Work with approved repair shops: Choose a repair facility recommended by your insurance company to ensure quality work.

Claims Settlement Process

- Assessing damages: Insurance adjusters will evaluate the extent of the damage to determine the coverage and settlement amount.

- Negotiating settlements: Work with the adjuster to reach a fair agreement on repairs and compensation.

Maximizing Benefits of an Auto Insurance Claim

- Review policy coverage: Understand what your policy covers to avoid any surprises during the claims process.

- Keep detailed records: Maintain a file with all communication, receipts, and expenses related to the claim for easy reference.

Documents Required When Filing an Auto Insurance Claim

| Document | Description |

|---|---|

| Accident report | Official report detailing the incident |

| Photos of damage | Visual evidence of the vehicle’s condition |

| Repair estimates | Quotes from approved repair shops |

| Medical bills | Relevant medical expenses related to the accident |

Auto Insurance Discounts

When it comes to auto insurance, discounts can help policyholders save money on their premiums. Insurance companies often offer various discounts to reward safe driving habits and encourage policyholders to take steps to reduce risks. Understanding the common discounts and eligibility criteria can help you maximize your savings on auto insurance.

Common Auto Insurance Discounts

- Multi-policy discount for bundling auto and home insurance policies.

- Good driver discount for maintaining a clean driving record.

- Low-mileage discount for driving fewer miles annually.

- Safety feature discount for vehicles equipped with anti-theft devices or safety features.

- Good student discount for young drivers with good academic performance.

Eligibility Criteria for Auto Insurance Discounts

| Discount | Eligibility Criteria |

|---|---|

| Multi-policy discount | Policyholder must have both auto and home insurance policies with the same company. |

| Good driver discount | Policyholder must maintain a clean driving record with no accidents or traffic violations. |

| Low-mileage discount | Policyholder must drive below a certain number of miles per year, as specified by the insurance company. |

| Safety feature discount | Vehicle must be equipped with anti-theft devices or safety features such as airbags and anti-lock brakes. |

| Good student discount | Young driver must maintain a certain GPA, typically a B average or higher. |

Impact of Defensive Driving Courses

Completing a defensive driving course can demonstrate your commitment to safe driving practices, potentially leading to discounts from insurance providers. These courses can help you improve your driving skills, avoid accidents, and qualify for additional savings on your auto insurance premiums.

Tips for Negotiating Lower Premiums

- Compare quotes from multiple insurance providers to find the best rates.

- Ask about available discounts and inquire about any new discounts you may qualify for.

- Consider increasing your deductible to lower your premium, but ensure you can afford the out-of-pocket expense in case of a claim.

- Review your coverage periodically and adjust it based on your current needs and circumstances to avoid overpaying.

Vehicle Safety Features and Discounts

Vehicles equipped with advanced safety features such as lane departure warning systems, adaptive cruise control, and automatic emergency braking may qualify for discounts on auto insurance premiums. These safety features can help reduce the risk of accidents and injuries, making your vehicle less costly to insure.

Understanding Coverage Limits and Exclusions

When it comes to auto insurance, understanding coverage limits and exclusions is crucial to ensure you have the right protection in place. Coverage limits determine the maximum amount your insurance company will pay for a covered claim, while exclusions are specific situations or items that are not covered by your policy.

Coverage Limits in Auto Insurance

Auto insurance policies come with various coverage limits for different types of protection, such as liability, collision, and comprehensive coverage. These limits are typically expressed as a set dollar amount per incident or per policy period. It’s important to review these limits carefully to make sure they align with your needs and financial situation.

- Liability Coverage Limits: This covers damages and injuries you cause to others in an accident. For example, a policy might have liability limits of $100,000 per person and $300,000 per accident.

- Collision Coverage Limits: This pays for damages to your vehicle in a collision. The coverage limit might be the actual cash value of your car at the time of the accident.

- Comprehensive Coverage Limits: This covers damages to your vehicle from non-collision incidents like theft or weather damage. The limit may also be based on the actual cash value of your car.

Common Exclusions in Auto Insurance Policies

While auto insurance provides essential protection, there are certain exclusions that may not be covered by a typical policy. Common exclusions include:

- Intentional damage or illegal activities

- Racing or using your vehicle for commercial purposes

- Regular wear and tear, maintenance, or mechanical breakdowns

Impact of Coverage Limits on Claims

Having inadequate coverage limits can significantly impact your ability to recover from an accident or loss. For example, if your liability coverage limit is $50,000 but the other party’s medical bills exceed that amount, you may be personally responsible for the remaining expenses. It’s essential to choose coverage limits that align with your assets and potential risks.

Ensuring Adequate Coverage for Specific Needs

To ensure you have adequate coverage for your specific needs, consider factors such as your vehicle’s value, your driving habits, and your financial assets. It may be beneficial to work with an insurance agent to assess your risks and tailor your policy accordingly. Regularly reviewing and updating your coverage limits can help you stay protected in various situations.

Auto Insurance for High-Risk Drivers

High-risk drivers are individuals who are more likely to get into accidents or receive traffic violations compared to the average driver. This increased risk makes them a challenge for insurance companies to provide coverage.

Factors Contributing to High-Risk Classification

High-risk drivers are often classified based on their driving history, which includes frequent traffic violations such as speeding tickets, DUI convictions, at-fault accidents, and license suspensions. These factors signal to insurance providers that the driver poses a higher risk of filing claims in the future.

Options for High-Risk Drivers to Obtain Auto Insurance

- Seek out specialized high-risk auto insurance companies that cater to drivers with a less-than-perfect driving record.

- Consider opting for state-sponsored assigned risk plans that guarantee coverage to high-risk drivers who are unable to secure insurance through traditional means.

- Explore the possibility of being added as a named driver on a family member’s policy to potentially benefit from their clean driving record.

Tips for Improving Driving Habits to Lower Insurance Premiums

- Enroll in defensive driving courses to enhance your driving skills and demonstrate a commitment to safe driving practices.

- Maintain a clean driving record by obeying traffic laws and avoiding risky behaviors on the road.

- Drive a safe and reliable vehicle equipped with advanced safety features that can lower the risk of accidents.

- Consider increasing your deductible to reduce your premium, but ensure you have enough savings to cover the higher out-of-pocket costs in case of a claim.

Auto Insurance Regulations

Auto insurance regulations play a crucial role in ensuring fair practices, protecting consumers, and maintaining a stable insurance market. These regulations are put in place at the state level and are overseen by insurance commissioners.

State-Level Regulations

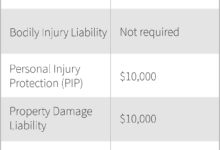

State governments regulate auto insurance through laws and regulations that dictate how insurance companies operate within their jurisdictions. These regulations cover aspects such as minimum coverage requirements, claim processes, and consumer protections.

- Insurance commissioners are responsible for overseeing the insurance industry within their respective states. They ensure that insurance companies comply with state laws and regulations, investigate consumer complaints, and approve insurance rates.

- Insurance laws aim to protect consumers by ensuring that they have access to affordable coverage, fair claim processes, and protection against unfair practices by insurance companies.

- Recent changes in auto insurance regulations may include updates to minimum coverage requirements, changes in claim procedures, or new consumer protection measures.

Comparison of State Regulations

- Auto insurance regulations can vary significantly from state to state. For example, some states may have no-fault insurance laws, while others operate under a traditional fault-based system.

- Comparing the regulations in two different states can highlight the differences in minimum coverage requirements, claim processes, and consumer protections.

Filing a Complaint with the Insurance Commissioner

- Consumers can file a complaint with the insurance commissioner if they believe an insurance company has violated state regulations or treated them unfairly. The process typically involves submitting a formal complaint, providing evidence, and waiting for the commissioner’s decision.

- Steps for filing a complaint may include contacting the insurance company first, gathering relevant documents, and submitting a complaint form to the commissioner’s office.

Penalties for Non-Compliance

- Insurance companies that fail to comply with auto insurance regulations may face penalties such as fines, license suspension, or other disciplinary actions. These penalties are designed to deter insurers from engaging in unfair or illegal practices.

- Non-compliance with regulations can also result in financial losses for insurers, damage to their reputation, and legal repercussions.

Evolution of Auto Insurance Regulations

- Auto insurance regulations have evolved over the years to adapt to changing circumstances, such as technological advancements, shifts in consumer behavior, and emerging risks. For example, regulations may be updated to address new types of coverage, cybersecurity threats, or changes in the transportation industry.

- Regulators continuously monitor the insurance market and make adjustments to regulations to ensure they remain effective and relevant in protecting consumers and promoting a competitive market.

Auto Insurance and Financial Responsibility

Understanding the concept of financial responsibility in the realm of auto insurance is crucial for all drivers. It entails the obligation to cover the costs of damages or injuries resulting from a car accident for which you are at fault.

Legal Requirements for Maintaining Auto Insurance Coverage

In most states, it is mandatory to have auto insurance coverage to operate a vehicle legally. The minimum requirements typically include liability coverage for bodily injury and property damage. Failure to maintain this coverage can lead to severe consequences.

- Driving without insurance can result in fines, license suspension, and even vehicle impoundment.

- Repeated offenses may lead to increased penalties, such as higher fines or community service.

- In the event of an accident, the uninsured driver may be held personally liable for all damages, leading to financial ruin.

Financial Risks of Being Uninsured or Underinsured

Being uninsured or underinsured poses significant financial risks that can have long-lasting consequences for individuals. In the event of an accident:

- Medical expenses for injuries sustained by you or others involved may have to be paid out of pocket.

- Repair or replacement costs for damaged vehicles can be substantial and burdensome without insurance coverage.

- Legal fees and potential lawsuits can arise from accidents, further adding to the financial strain.

Auto Insurance Industry Trends

Artificial intelligence, blockchain technology, big data analytics, autonomous vehicles, and pay-per-mile insurance are shaping the future of the auto insurance industry.

Impact of Artificial Intelligence on Claims Processing

Artificial intelligence is revolutionizing claims processing in the auto insurance sector by automating tasks, improving accuracy, and speeding up the claims settlement process. AI algorithms can analyze data efficiently to determine liability, assess damages, and detect fraud, ultimately enhancing customer experience and reducing costs.

Blockchain Technology for Transparency and Security

Blockchain technology is being utilized to enhance transparency and security in auto insurance transactions by creating tamper-proof records of policy information, claims history, and payments. The decentralized nature of blockchain ensures that data is secure, immutable, and easily accessible, reducing the risk of fraud and improving trust between insurers and policyholders.

Role of Big Data Analytics in Fraud Prevention

Big data analytics plays a crucial role in predicting and preventing insurance fraud within the auto industry by analyzing large volumes of data to identify patterns, anomalies, and suspicious activities. Insurers can leverage data analytics to detect fraudulent claims early, mitigate risks, and protect their bottom line.

Influence of Autonomous Vehicles on Insurance

The rise of autonomous vehicles is reshaping insurance rates and coverage options as insurers adapt to the evolving risks and liabilities associated with self-driving cars. Factors such as accident frequency, severity, and liability are being reevaluated, leading to potential changes in premiums and policy terms to accommodate the new technology.

Pay-Per-Mile Insurance Models

Pay-per-mile insurance is disrupting traditional auto insurance models by offering a more personalized and cost-effective approach to coverage. Policyholders pay premiums based on the number of miles driven, promoting safer driving habits, reducing environmental impact, and providing flexibility for occasional drivers or those who use alternative modes of transportation.

Auto Insurance and Consumer Rights

When it comes to auto insurance, policyholders have certain rights that protect them during the claims process and interactions with insurance companies. Understanding these rights is crucial for ensuring a fair and smooth experience.

Rights of Policyholders

Policyholders have the right to a fair claims process, which includes timely responses from the insurance company, transparent communication, and a thorough investigation of the claim. They also have the right to appeal decisions made by the insurance company if they believe the outcome is unfair.

Common Issues and Disputes

- Claim denials and disputes often arise due to insufficient documentation or disagreements over coverage. Policyholders should ensure they provide all necessary information and review their policy to understand what is covered.

Tips for Protecting Consumer Rights

- Keep thorough records of all communication with the insurance company, including emails, letters, and phone calls.

- Review your policy regularly to understand your coverage and rights as a policyholder.

Resources for Consumers

- State insurance departments and consumer protection agencies can provide assistance and guidance to consumers facing insurance-related concerns.

Key Steps for Filing an Auto Insurance Claim

| Steps | Actions |

|---|---|

| Document the Incident | Take photos, gather witness information, and file a police report if necessary. |

| Contact the Insurance Company | Notify your insurance provider of the incident and submit the claim. |

| Follow Up on Claim Status | Regularly check the status of your claim and provide any additional information requested. |

A policyholder successfully resolved a claim dispute with their insurance company by providing detailed documentation of the incident, including witness statements and photos, which supported their claim.

Auto Insurance and Uninsured Motorists

Uninsured motorists pose a significant risk to insured drivers on the road. These drivers do not carry auto insurance, which can lead to complications in the event of an accident.

Impact of Uninsured Motorists on Insured Drivers

- Uninsured motorists can create financial burdens for insured drivers if they are at fault in an accident.

- Insured drivers may have to rely on their own insurance coverage to repair damages or cover medical expenses.

- Increases in uninsured motorists can also impact overall insurance rates for all drivers.

Uninsured Motorist Coverage

- Uninsured motorist coverage protects policyholders in the event of an accident with a driver who does not have insurance.

- It can help cover medical expenses, lost wages, and vehicle repairs if the uninsured driver is at fault.

- Having this coverage ensures that insured drivers are not left with significant financial losses due to another driver’s negligence.

Prevalence of Uninsured Drivers

- According to the Insurance Information Institute, the percentage of uninsured motorists varies by state, with some states having higher rates than others.

- States like Mississippi, New Mexico, and Michigan have reported higher percentages of uninsured drivers compared to the national average.

- It is estimated that around 13% of drivers nationwide are uninsured, highlighting the importance of having uninsured motorist coverage.

Legal Implications of Accidents with Uninsured Motorists

- Accidents involving uninsured motorists can lead to legal complications for insured drivers, especially when it comes to seeking compensation for damages.

- Insured drivers may have to pursue other avenues to recover their losses, such as personal injury lawsuits or uninsured motorist claims.

- It is crucial for insured drivers to understand their rights and options in such situations to ensure they are adequately protected.

Auto Insurance and Vehicle Safety Features

Vehicle safety features play a crucial role in determining auto insurance premiums. Insurers consider the presence of advanced safety technologies in a vehicle as factors that can reduce the likelihood of accidents and claims, resulting in potential insurance discounts for policyholders.

Impact of Safety Features on Insurance Premiums

- Anti-lock Braking Systems (ABS): ABS can help prevent skidding and improve vehicle control in emergency braking situations, leading to lower insurance premiums.

- Electronic Stability Control (ESC): ESC enhances vehicle stability and reduces the risk of rollovers, resulting in potential discounts on insurance rates.

- Forward Collision Warning Systems: These systems alert drivers of potential collisions, reducing accident risks and qualifying for insurance discounts.

Role of Vehicle Security Systems

- Vehicle security systems such as alarms and immobilizers can deter theft and vandalism, leading to lower insurance costs for policyholders.

- Dash Cameras and Telematics Devices: Installation of these devices can provide valuable data for insurers, potentially influencing insurance rates based on driving behavior.

Insurance Benefits of Safety Features

| Safety Feature | Impact on Insurance Premiums |

|---|---|

| Blind Spot Monitoring | Potential discount for reducing blind spot-related accidents. |

| Lane Departure Warning | Discount for preventing lane departure accidents. |

| Rearview Cameras | Possible savings for reducing rear-end collisions. |

Insurance industry experts emphasize the importance of investing in vehicle safety features not only for personal safety but also for potential savings on insurance premiums.

Outcome Summary

In conclusion, auto insurance is a vital aspect of responsible vehicle ownership. By choosing the right policy, understanding coverage limits, and staying informed about industry trends, you can ensure peace of mind on the road. Stay safe and insured!